Editor's Note

Federal investments are bringing billions of dollars into clean energy industries, creating good-paying jobs, lowering energy costs, and cutting pollution. But right now, those programs are under threat from both the Trump administration and Republicans in Congress. Our work isn’t done. In order to assist federal agencies, states, local communities, Tribal governments, businesses, and other partners to take full advantage of this funding, Evergreen has put together a collection of resources to help defend and implement key programs in the Inflation Reduction Act (IRA).

The Inflation Reduction Act (IRA) invests historic levels of funding toward addressing climate change through a broad spectrum of incentives for clean energy and equity-centered environmental investments. Done right, the IRA, combined with dedicated and thoughtful state and local action, can support a just transition—a systems change where all communities and workers, regardless of age, race, or zip code, are brought along in the pivot to a thriving clean energy future.

From the rural towns in Appalachia to the Gulf of Mexico to the Alaskan Arctic, low-income communities, communities of color, and Indigenous communities have long been forced to live near pipelines, coal plants, and refineries associated with the production of dirty fuels. Simultaneously, these industries have also dominated and shaped the local economy, and these communities will be most hard hit by the transition away from fossil fuels.

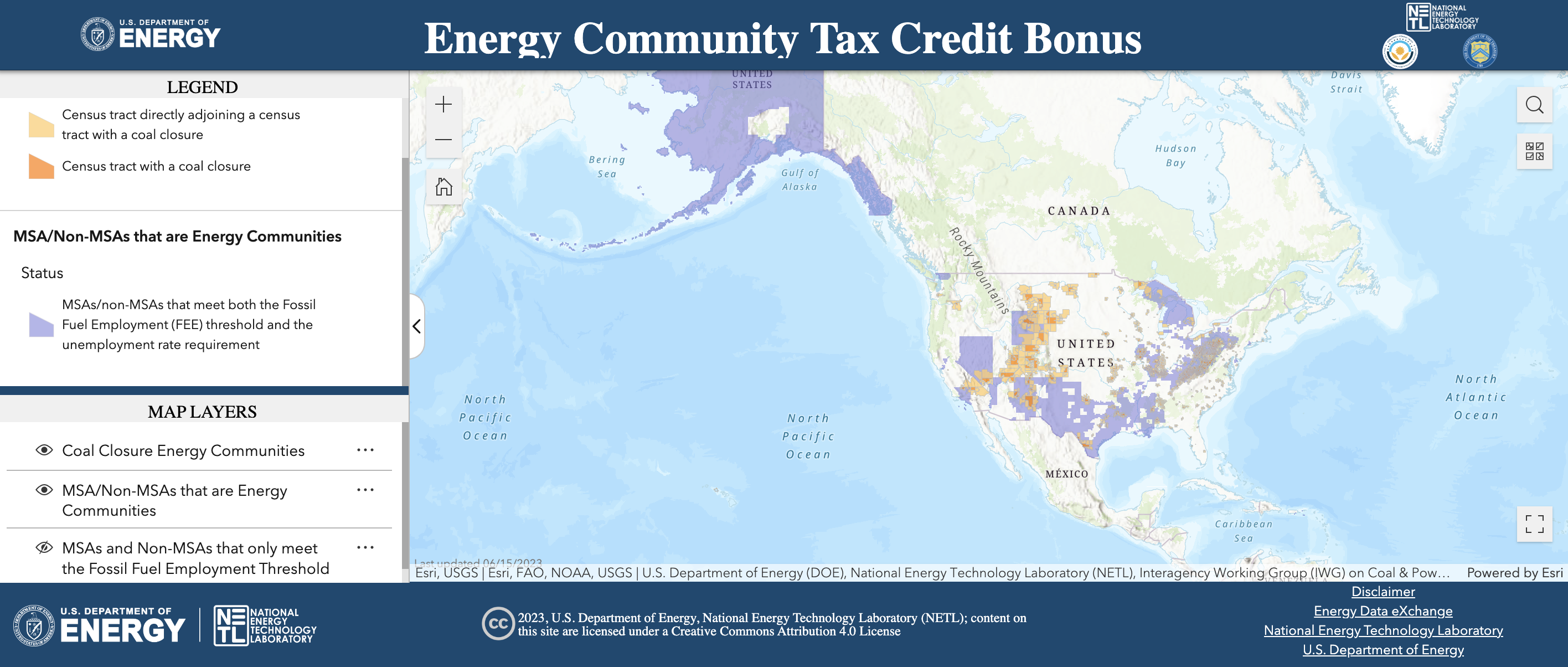

But there is a future beyond reliance on polluting industries—and the IRA will help unlock it. Thanks to IRA funding and tax credits specifically targeted at these communities—which the IRA calls “energy communities”—federal support can be mobilized to secure good jobs in a new clean energy landscape.