On Thursday at 8:45 am EST, the Senate Committee on Banking, Housing, and Urban Affairs will hold a confirmation hearing for three members of President Biden’s proposed slate of nominees for The Federal Reserve Board of Governors.

These nominees are exceptionally qualified candidates who enjoy broad ranging support and should be confirmed expeditiously. Key points to note ahead of tomorrow’s hearing:

- The Washington Post Editorial Board said these nominees “are ready to help lead the Fed and bolster its credibility. The Senate should move quickly to put them in place.”

- The Bloomberg Editorial Board described Biden’s slate as “widely accomplished and well qualified.”

- This week Senator Joe Manchin applauded all of the nominees on President Biden's slate, calling them “extremely qualified.”

- Current Trump-appointed Fed Chair, and nominee for a second term, Jerome Powell has committed to addressing climate-related financial threats as a part of the Fed’s mandate.

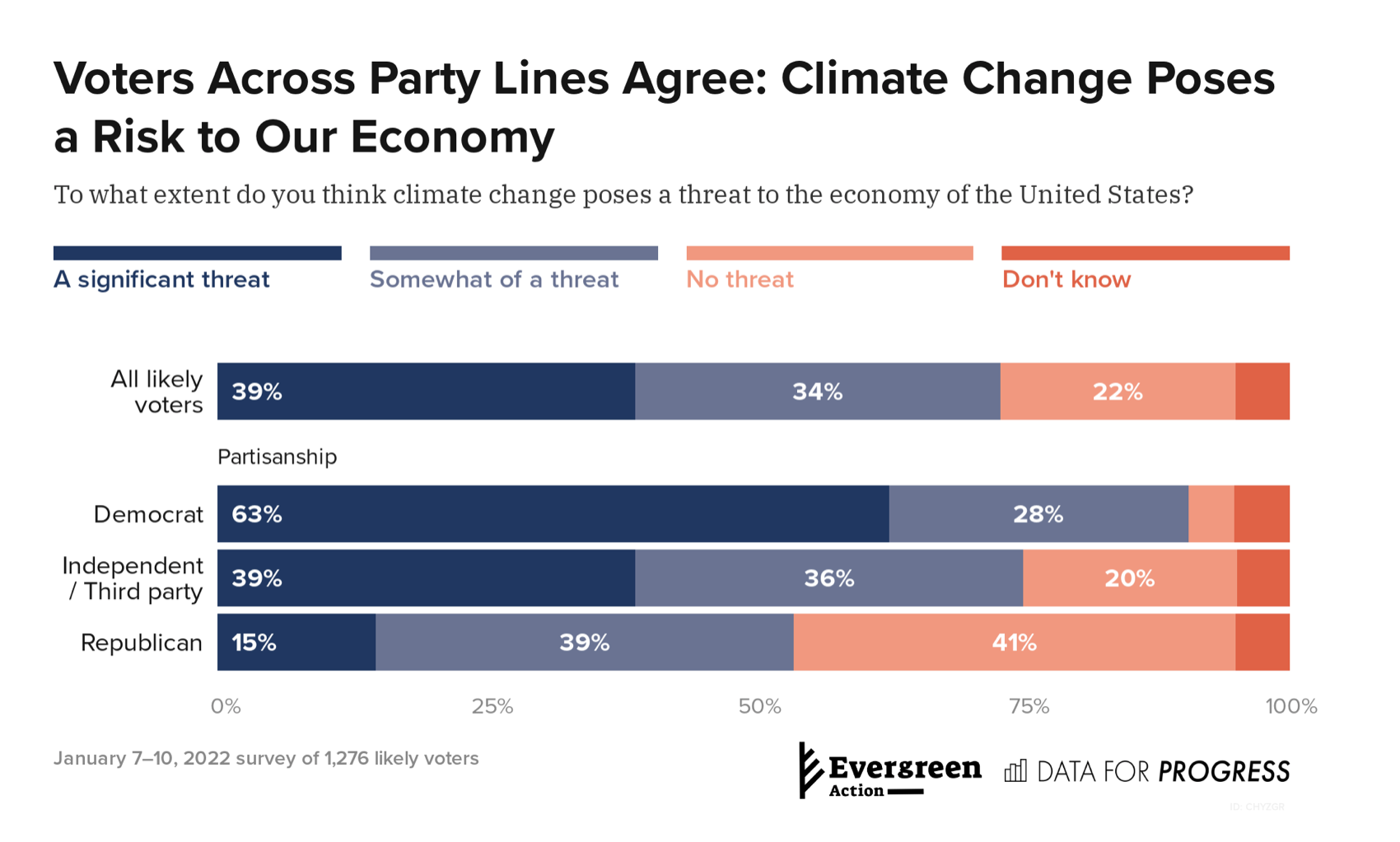

- Roughly three quarters of likely voters think climate change poses a threat to the U.S. economy, including majorities of Democrats, Independents and Republicans.

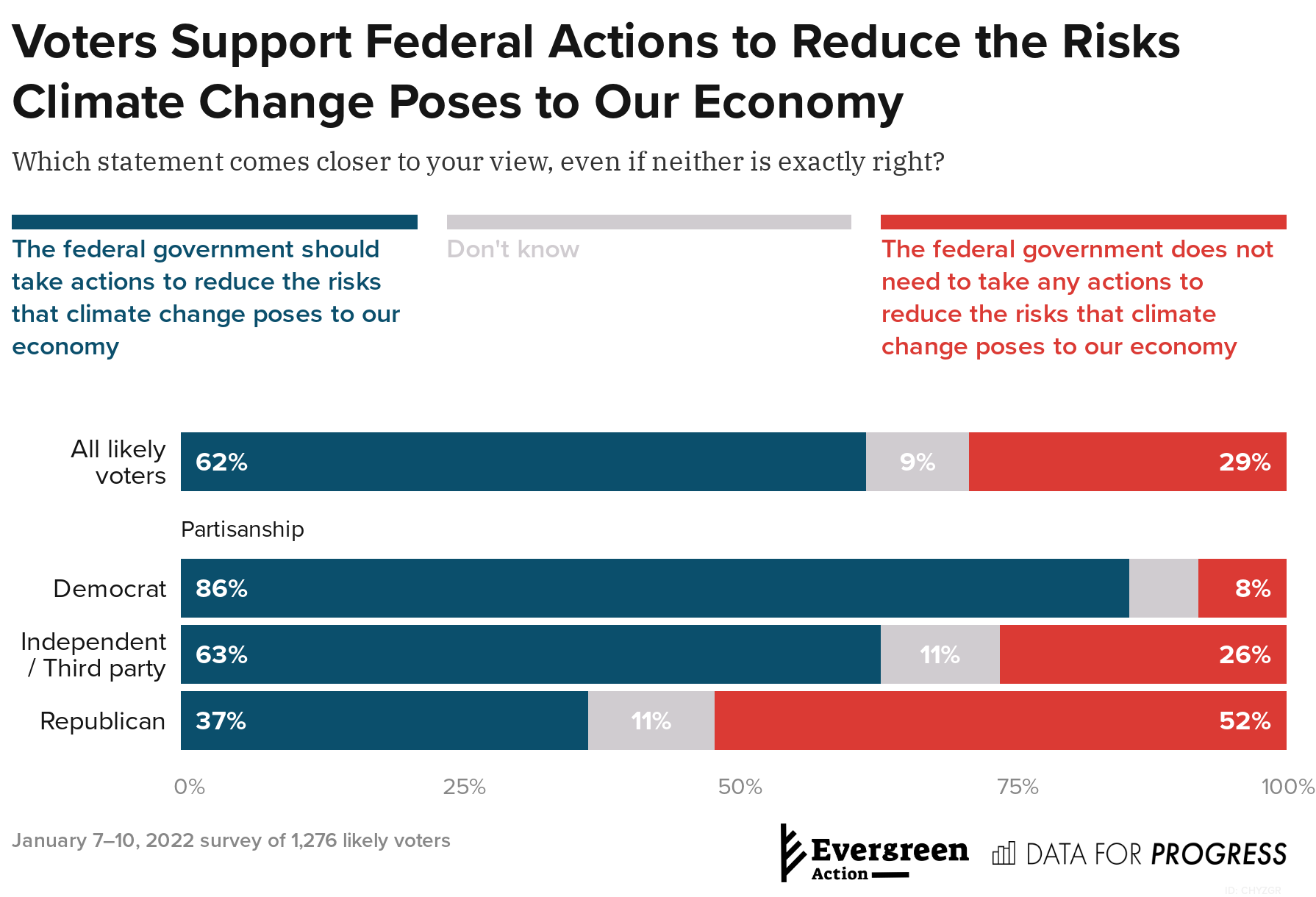

- By a 33-point margin, likely voters support federal intervention to reduce the risk climate change poses to the economy.

- 9 out of 10 Chief Risk Officers from 88 financial institutions view climate risk as a top emerging threat in the next five years.

- 95% of insurers report believing that climate risk translates to investment risk.

Thursday’s hearing will see a slate of highly qualified nominees who are each prepared with unique skill sets that will allow them to excel in their respective roles at The Fed, should they be confirmed. With decades of experience in academia and the public and private sectors, Lisa Cook, Philip Jefferson, and Sarah Bloom Raskin will bring non-partisan competence and a pragmatic approach to bank regulation that will ensure the continued independence of The Fed as an institution. Republicans and Democrats alike have praised their preparedness to lead the Fed, with Senator Joe Manchin describing them as “extremely qualified.” The slate of nominees put forth by President Biden is one that’s historically diverse, with the nomination of the first-ever African-American woman to serve, and only the fourth appointment for an African-American man. These are long overdue appointments that will reflect the true makeup of our nation and the American economy.

Yet despite their impressive resumes and praise from leading economists and former colleagues alike, there have already been signals that these nominees will face bad-faith attacks from elected officials in the pocket of the fossil fuel industry at tomorrow’s hearing. Despite what you’re likely to hear from climate-denying Senators tomorrow, those attacks are completely out of step with business leaders, banks, economists, everyday Americans, and even Republican appointed former Fed Governors, who all recognize the threat that the climate crisis poses to our financial system, and are calling for more action and guidance from financial regulators to protect our economy.

Taking action to protect our financial system from the threat of climate related-financial risk is not only within the Fed’s purview, but is in fact necessary to fulfill the central bank’s mandate to address emerging risks and protect financial stability. As current Fed Chair Jerome Powell explained, “Climate is appropriate for us [The Fed] as an issue to the extent it fits within our existing mandates, in the sense of it’s another risk over time that banks are going to run.” Biden’s slate of nominees to the Board of governors are eminently qualified, and prepared to tackle the emerging risks that threaten to destabilize our economy. They should be confirmed without delay.

Financial Institutions Are Calling For More Guidance From Regulators

Amidst ongoing inflation concerns and economic ramifications from the Covid-19 pandemic, the financial sector is looking for leaders at the Fed who will be committed to fighting inflation and maintaining stability, while protecting against potential threats that are on the horizon. Financial institutions recognize the threat posed by climate change and are actively soliciting clear, comprehensive guidance from the federal government to be responsible fiduciaries to their clients in a world of ever-increasing climate risk. That’s why industry groups like the American Bankers Association have welcomed Biden’s slate of nominees.

In a survey of Chief Risk Officers from 88 financial institutions, nine out of ten agree that climate risk is a top emerging threat in the next five years. This comes as 95% of insurers report believing that climate risk translates to investment risk, and 215 of the biggest global companies, representing $17 trillion in market capitalization, reported almost US $1 trillion at risk from climate impacts—with many likely to hit within the next five years.

In a letter to other CEOs, BlackRock CEO Larry Fink put it plainly: “Capitalism has the power to shape society and act as a powerful catalyst for change. But businesses can’t do this alone, and they cannot be the climate police. That will not be a good outcome for society. We need governments to provide clear pathways and a consistent taxonomy for sustainability policy, regulation, and disclosure across markets.”